Business Insurance in and around Carrollton

Calling all small business owners of Carrollton!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

Calling all small business owners of Carrollton!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, commercial auto or commercial liability umbrella policies.

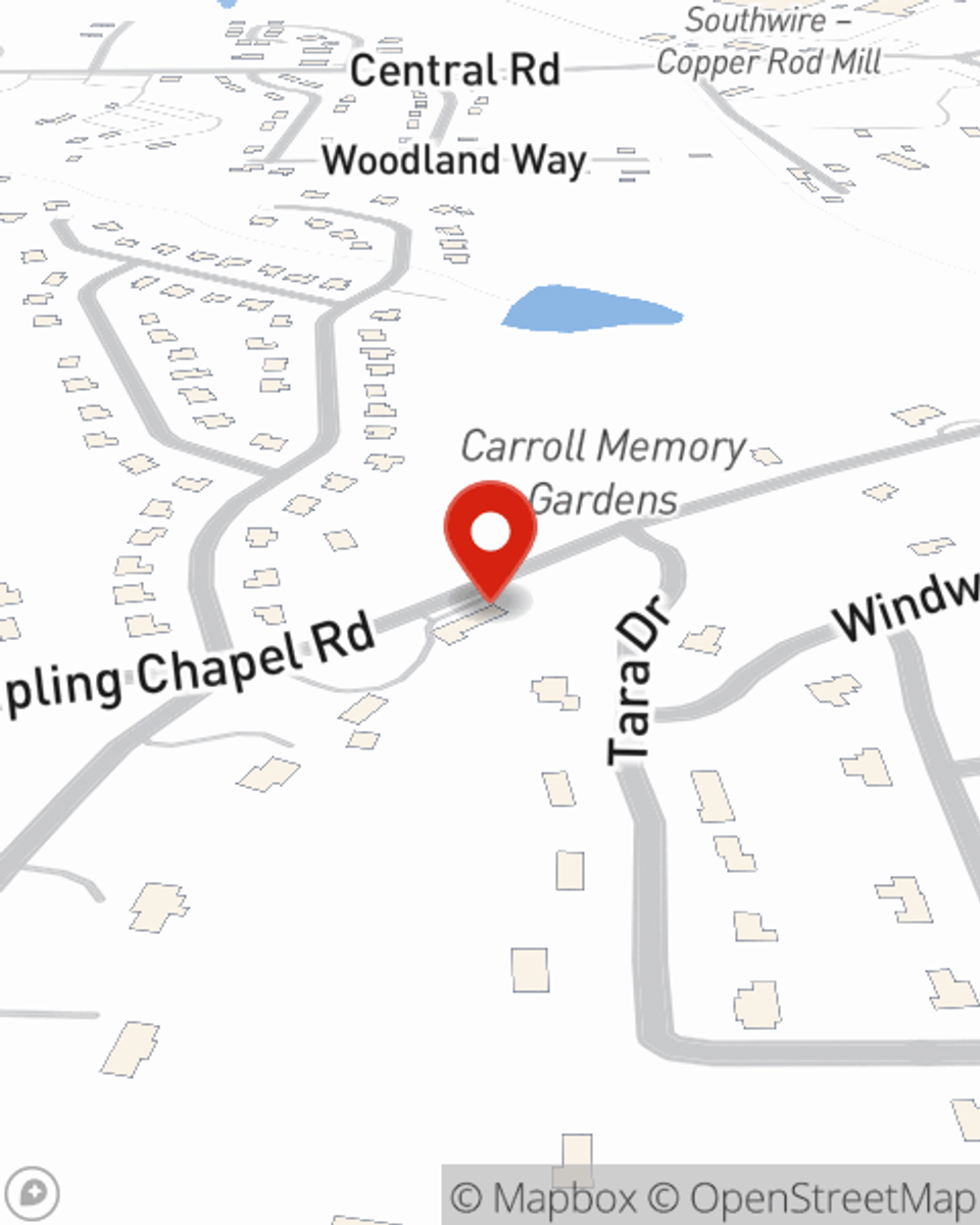

As a small business owner as well, agent Meg Wilson understands that there is a lot on your plate. Visit Meg Wilson today to chat about your options.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Meg Wilson

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.